Financial stress is very common and very evident to occur in this current global scenario where the expenditure is higher than income. But, even in these tough times, some people are able to keep their heads calm and handle the situations easily, whereas others succumb to it. Now, some might have a question in mind as who is better in managing financial expenses? The answer would be biased if we point out at a particular gender and tell you that one of the two- men or women are good at money management. The truth is, anyone can be good at managing finances if they know how to do it properly.

So below are some tips to address all money-related issues in family or relationships.

#1. Spend Less Than What You Earn

Earn more and spend less for a life free of financial conflicts. We desire for more than what we can afford, which leads to all most every trouble and distress in life. It might sound obvious and might not look like something important, but this is the very basic rule of good money management.

(Image Courtesy: Family Fun Canada)

#2. Remember How Much You Spend

Knowing your numbers keep you stress-free. Most of the times, when people don't remember how much they spent, they get stressed. Thus, it's better you know what you paid for and how much you paid for. Start maintaining a spreadsheet of your expenses, and use budget trackers to keep a record of your expenses.

(Image Courtesy: Sydney Financial Planning)

#3. Take Time With Your Decisions

If you're not sure of something, no need to spend the money. Take your time and try to give yourself space and time to think, also involve your partner in it. Try not to get emotional while spending or you'll end up overspending.

(Image Courtesy: Birch Blog)

#4. Don’t Hide Anything From Your Partner

Men and women often hide their secret expenses with each other which results in financial issues in the family. To manage things better, trust each other and don't keep your partner in the dark. Share all the extra purchase that you have done, and expect the same from your partner.

(Image Courtesy: New Track English)

#5. Don't Cross Your Boundaries

If something is out of your budget and is not even a part of the budget, think twice or thrice before making the purchase. There is a situation when we spend on unnecessary things and regret the purchase later. Try to stop yourself when you know that a specific purchase will disbalance your entire budget.

Don’t even think about buying products like a car, a house etc. without proper planning and reaching a mutual agreement with your partner.

(Image Courtesy: Hindustan Times)

#6. Save For The Rainy Days.

You never know when the time and situation will turn against you. Life is unpredictable and a happy moment might turn into a sad one with the drop of a hat. So, no matter how much you manage to earn, always keep a backup to tackle these ‘unpredictable and surprising' situations with ease. No one knows when the rainy day might occur, so just be prepared. Even a drop of water saved every day can fill a pond after some time.

(Image Courtesy: Born Birch)

#1. Set Goals

Before you start putting your money into use, the first task is to assess your needs. Make a monthly goal to address every financial goal one by one and share it with your partner. Work on it together and strike off goals one by one after achieving them.

(Image Courtesy: Van Digit)

#2. Identify Income And Expenses

To know how much you can actually spend, you've to know all the income sources and how much they calculate collectively. The second task is to find out the actual expenses. This can be a little tough because you have to track the expenses of all your family. Include everything like groceries, utilities, food, electricity, home loans, and savings etc.

(Image Courtesy: The Digerati Life)

#3.Differentiate Needs From Wants

There are certain things which we desperately need for survival, while there are certain others which we just want and purchase them impulsively. Now, if you want to avoid conflicts later on, learn to keep a control on your impulsive spending behavior and spend on things which you really need. Now differentiating between a need and a want is only possible after mutual discussion with your better half, so consider that.

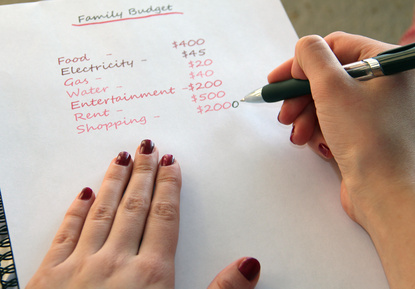

#4. Create A Budget

A budget is very crucial for good money management. Make a budget and compile all your spending habits and you'll get to know whether your expenditure is exceeding your income. Find out the areas where you can cut back and put it into savings.

(Image Courtesy: Recapturing Faith)

#5. Improvise When Needed

Needs might increase with time and survival may get difficult without addressing the needs. Thus, if possible, cut out on individual expenses which are possible to manage and spend on the newly occurred expenses. A newborn child might require restructuring the current budget, and in such times improvisation of the budget becomes inevitable.

#6. Save For Extras

As discussed above, needs might increase with time and introduction of new family members. Thus, a family and their budget must be always prepared for the extra expenses whenever needed. A situation like the higher education of the child, a need for some extra space or a new house, or any critical emergencies may require instant financial support; and trying to cut back on the expense to create space for the newly introduced expense might not work out well. Thus, no matter how much you earn, saving a little of your earnings is always considered a good idea.

(Image Courtesy: Wylies)

Out of all the primary reasons for conflict, money is one of the major ones leading to conflicts between families with the strongest bonds. Despite the US economy's progress in the last couple of years, money and finances remain the top two reasons for stress among families below median income group.

This trend has been observed among millennials and Gen Xers, especially among parents having children below 18 years. And with this dramatic rise in numbers, addressing the situation has become crucial.

#1. Sit down with the family in a good state of mind before the crisis prevails, and discuss the scenario with the whole family.

#2. Be honest and involve all the siblings and parents. Keep the discussion less emotional and more practical.

#3. Let your parents have a larger say, they have dealt with such situations in the past and are more experienced than you.

#4. Work together to address and resolve the past conflicts, past grievances with other family members, and/or preconceived notions that might lead to snide remarks later on.

(Image Courtesy: Nationa; Debt Relief)

A family provides a sense of belonging and security if the members are focusing towards one goal- living with peace and harmony. But, in most cases, families fail to secure that harmony conflicts, leading to a threat to the feeling of security. Thus, no matter how the conflict arises, or what initiated the conflict, the prime focus is to resolve it before it destroys the entire family and leads to an unrepairable damage.

#1. Jobs And Finances

Lack of funds to meet the basic needs of the family often becomes the reason for conflict in families. Every family suffers from bad time and fails to manage enough finances to meet all the demands like paying mortgage, bills, buy food due to various reasons like unemployment.

To address this problem, it's suggested to keep your nerves calm against the stress that comes with unemployment and dealing with the issues.

#2. Rivalry In Siblings

Every child seeks attention and approval from their parents at any cost, and the parents failing to comprehend the situation leads to inevitable rivalry among siblings.

To avoid this problem, the parents have to be cautious from the very beginning. Each child deserves equal love and attention from their parents. And parents should ensure that they are not favoring one child, alienating the other and introducing jealousy among them.

(Image Courtesy: DebtFridigi)

#3. Lack Of Disciplinary Agreement

It is very common in families that one parent acts as the disciplinarian, while the other acts as the console. Parents might not realize this instantly, but this lack of a mutual agreement about discipline between the parents leads to a bigger trouble later on.

Parents need to come up with a disciplinary agreement at the start of parenting to avoid future conflicts. Or this lack of consensus on the matter of child might lead to family conflicts.

#4. Extended Families

Getting involved in disagreements with in-laws or extended family members is very common, but it becomes a serious issue when in-laws start interfering in family conflicts.

To avoid such situations, respect your elders on both sides equally, but keep them away from family discussions.

(Image Courtesy: Students Loan Consolidation)

Money issues will come and go, but what is important is, we should be ready to tackle them all. We hope you liked the article. Let us know your secret tips for money management using the comment section.

(Featured Image Courtesy: Business Insider)