Inflation, in general, refers to increase in the price of goods and commodities over a period. Rising inflation often results in loss of value of currency.

Inflation can be measured through different indices, some of which can be listed as:

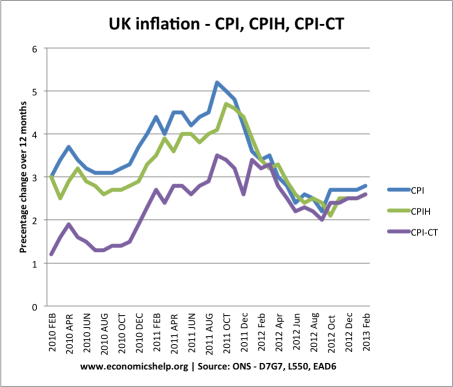

Consumer Price Index includes taxes and some other financial services. However, Consumer Price Index excludes interest payments on mortgage and housing costs. This indicator to measure inflation is used in Britain. The country has set an inflation target of 2 percent based on the Consumer Price Index.

This refers to indirect tax which impacts inflation. However, it also helps in determination of effects of inflation and it generally ignores the increase in tax.

This is a combination of indexes through which average changes over time can be measured. These changes are measured from the perspective of the seller. Producer Price Index is mainly used in the United States of America.

Some misconceptions about inflation rate

While Consumer Price Index is the standard method of measuring inflation, certain misconceptions also exists when it comes to inflation. Fall in inflation has nothing to do with fall in prices. In the year 2009 also inflation dropped from 5 percent to 1 percent but the prices continued to rise.