Private Mortgage Insurance, often shortened as PMI, is a mortgage insurance that a home buyer is required to pay for in case of a conventional loan. Like the several other kinds of insurance, it also protects the lender and not the buyer, but the money goes out of the latter’s pocket.

Who provides the PMI are the private insurance companies, and it

(Image Courtesy: Houseopedia)

How To Calculate Mortgage?

There are

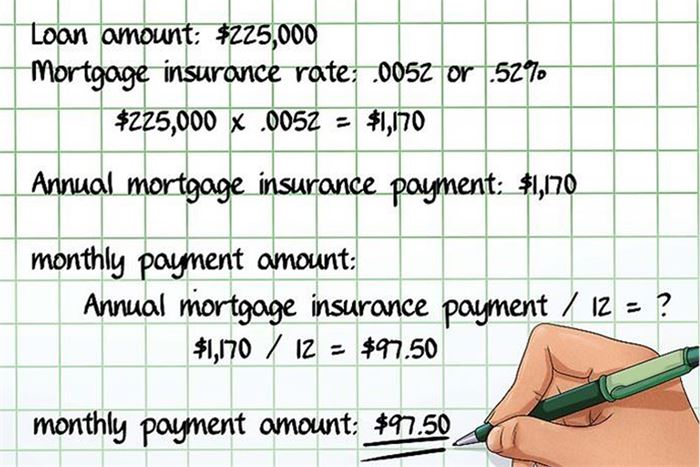

Based on the various factors, your PMI rate can vary from 0.3

percent to 1.15 percent of the total loan borrowed. You can find the

exact rate applicable in your case through the table available on the

lender’s website. After that, you can do the math by multiplying the rate

applicable

(Image Courtesy: Wiki How)

How Long Do You Pay It?

It is important to note that you do not need PMI if you create

enough equity in the property. Once you have acquired 20 percent

ownership in your home, you can submit a request to your lender to

cancel the mortgage insurance. Lenders only automatically cancel the

mortgage insurance when you reach 22 percent equity, but you can

(Image Courtesy: Business Wire)

How Do You Pay It?

Your lender may require you to pay monthly premiums or a one-time

upfront premium at the time of closing. In the former case, the

mortgage payment

There is also a third option where you make a small one-time

upfront payment as well as pay monthly premiums. Most of the time, the

lender offers more than one option

(Image Courtesy: Wiki How)

We hope that is all you wanted to know. Share your thoughts about the post through your comments in the box below.

(Image Courtesy: Rate Market Place)