Financial institutions have stepped out of most of the traditional approaches to investment opportunities internationally, understanding the potential of growing businesses and project-based investment plans that allow organizations to find the capital to make the most of their ideas and business plans.

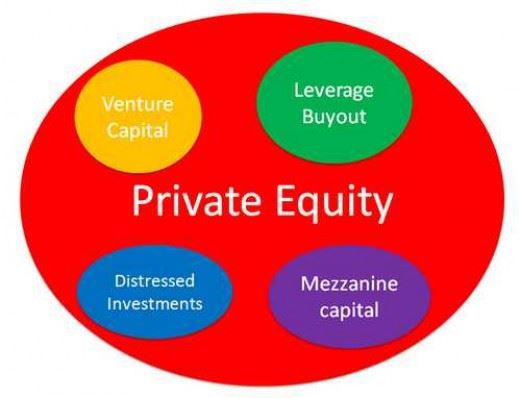

The markets are high risk and meaningful investors looking for an opportunity to help their capital develop are in need of highly trained financial professionals to act as mediators and brokers between those who require the capital investment and those providing it for the sake of mutual gain. It is a process which entails trust and skilled professionals at the helm of operations to navigate the market effectively and make lasting deals occur through management and effective networking. Private equity, as such, has grown into a popular industry, arriving at the intersection of technology and finance, attracting people from IT companies for the analysis and technology it incorporates into the operational process. It is a minor revolution empowering only the best trained and dedicated professionals to succeed in the long run.

Today, we take a closer look at the type of roles in the hierarchy of private equity firms

• The chain of the hierarchy of a private equity firm are financial analysts(either straight from school or selected from a second-year examiner position at investment banks), associate, senior partner, chief or primary, overseeing executive or accomplice lastly the pined for part of overseeing accomplice.

• The most looked for after part in private equity is that of the 'originator', which is usually the partner at a firm. As the name recommends, these are highly driven individuals searching out new organizations that the private equity firm can put resources into and, at last, getting the arrangement over the line.

• Principals evaluate whether an arrangement merits being pursued for the sake of the firm. On the off chance that it is, they have duty regarding guaranteeing they have all the correct documentation set up and arranging the correct cost. They are responsible for sorting the priorities of the various investment projects that the firm has undertaken and requires to deliver upon in an adequate fashion.

• Junior private equity roles are widely contested and sought after– there are ordinarily around 200-300 applications for each accessible part and just 10% of CVs are shortlisted for meet. However, these few are not ever lacking work, engaged with comprehensive financial matters almost every day at the firm, under the instruction of their superiors who watch their performance with care. These are usually given to those candidates who seem fit to be groomed by the organization

• Another important activity in private equity, which is regularly neglected, is investor relations and how it affects the image and stature of the organization. Private equity firms can't contribute without subsidizing, and it's the investor relations groups who create connections with potential new investors and keep up them with existing ones. Investors are referred to as 'Limited Partners’ and they've turned out to be progressively requesting more data and a convincing case for putting resources into a specific store, so investor relations experts have turned out to be more popular as time has gone on. Retaining their services and abilities is vital toward fostering the networks that thrive in making these industries work together