Sudden and uninformed nationwide announcement like ‘demonetisation’ has led to panic and disruption across businesses and industries in India.

With households reducing discretionary consumption, demonetisation has hit businesses of all orders. Demonetisation has impacted the following key sectors: real estate, consumer goods, consumer durables, organised retail markets, automobiles, tourism, infrastructure and pharma.

Even though the impact is estimated to be short-term, seasonal businesses have been affected the most.

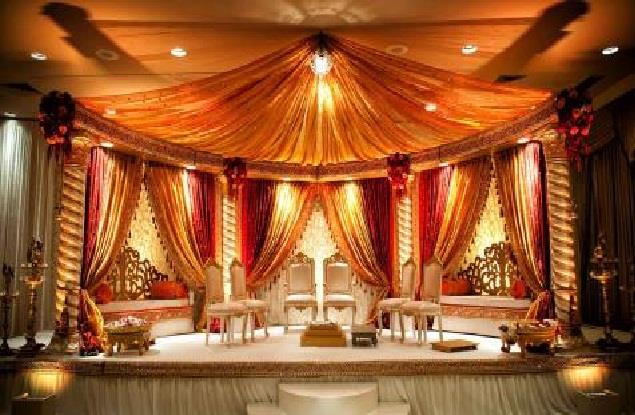

The most sought-after industry, Indian wedding industry is pegged at INR 100,000 crore rupees (as of 2015) with a growth rate of 25% - 30% y-o-y. With a revolutionary move like this being announced at the peak of the wedding season, 2016 is going to be remarkably different.

The roll-out of demonetisation has impacted the wedding season and all of it's affiliated businesses - jewellery, designer clothing, accessories, catering and decor, wedding venues, photography, tourism and personal grooming. This sector has been hit hard as most of the transactional formats are largely cash driven.

According to World Gold Council, Indian weddings account for 50% of the annual gold sales in India. Jewellers have taken a big whip as October-November is usually when jewellery sales are at its peak due to the high-demand wedding season. Gold shopping has undergone a sea of change primarily due to two reasons i) Shortage of cash & ii) Fear of IT department keeping a close watch in case of an all-white transaction. With reducing footfalls and low volumes, sales are down to the extent of 80%.

Garment businesses have taken a beating in the wake of the ongoing wedding season and demonetisation. Consumers are still facing liquidity issues ensuing deferred purchases and shopping schedules. Traders are hardly managing to rake in 10% of the approximated business and to make things worse, already-placed orders are getting scrapped due to shortage of currency. Indian fashion industry is also restructuring its business model to adapt to the current financial conditions.

Local decorators, florists, caterers and other conventional vendors are unwilling and sceptical of accepting cheques or digital payments.

Daily wage labourers (the daily bread earners) associated with these services are affected the most since their primary mode of payment was cash and now cheques take at least 2 - 3 days for bank clearance.

Although there has been a change in buying pattern from cash to online/debit transactions, the spends are consciously curtailed. For those who could, have already managed to shift their spends to be largely dependent on a credit lending basis.

The situation is even worse in the rural areas and towns (low banking zones) of India - where cash is the sole or the primary mode of transaction.

Some visible adjustments by Indian families

- Families are giving wedding planners/organisers a skip and managing small scale functions by self

- Destination weddings are getting called off

- Simple, short, non-elaborate and limited ceremonies are preferred

- E-invites are being sent out in place of heavy/designer physical cards

- Number of guests to be invited are getting cutdown

- Authentic gold jewellery is getting replaced with imitation designer jewellery

- One central photographer is getting allocated for all occasions in place of multiple specialised photographers for multiple occasions

- Wedding dresses are getting hired/rented instead of buying designer wedding wear

- Expensive gifts to relatives/family friends are getting toned down or completely getting skipped

- Bearing travel and boarding costs of guests are getting shunned on

- Acceptance of cash by digital/mobile accounts/apps is accounted for

- Honeymoons are getting postponed to a later date

Wonder what’s the most unfortunate part? At this juncture, families are unable to access their own bank accounts for which they have been saving up all their life.

Although RBI has sanctioned wedding withdrawal of up to INR 2.5 lakhs cash (with its terms & conditions), it can hardly suffice for the cash transactions to be made. The season has dampened the spirits of brides and grooms-to-be with them having to face the wrath with compromises to be made on several fronts. Weddings, engagements and other associated traditional functions are getting postponed till the financial situation in the country stabilises. Some families are even knocking off some ceremonies, events and doing away with ‘lavish’ and ‘elaborate’ weddings. Cash-strapped Indian families have had to re-think their plans and costs. With such a major overhaul and toned-down scales, this wedding season has lost its shimmer.

Dreams have been shattered, marriages have been postponed and marriages have been broken. The rupee has shrunk and wedding blues have multiplied. Not a big-fat-Indian-wedding season after all!