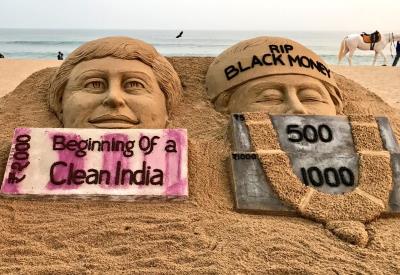

With the Prime Minister’s announcement of discontinuing Indian currency notes of Rs. 500 & Rs. 1000 on the 8th of November last year, businesses across India have been struggling to find their ground. The sudden demonetization move created a massive void as the discontinued notes account for almost 90% of the total cash in the Indian economy.

India being a strong cash economy, daily transactions of a majority of the people and businesses have been disrupted. As in the case of any financial crisis, economic studies point out that people first cut down on their luxuries, and focus on their immediate necessities. From a consumer’s point-of-view, travel & hospitality is more of a luxury choice than a necessity. Obviously, in light of a cash crunch, extravagant travel plans don’t fit in.

Some argue that the timing of the move to demonetize the currency was ill-timed as it did not factor in the tourist season, among the many economic activities in the winter.

The tourism industry contributes yearly to more than 10% of the jobs created in India and nearly 7% of the GDP in the Indian economy. The tourism and hospitality industry together directly contributed nearly US$ 43 billion to India’s GDP in 2015 and was expected to contribute nearly US$ 47 billion by the end of 2016. However, the figures went south post 8th November 2016.

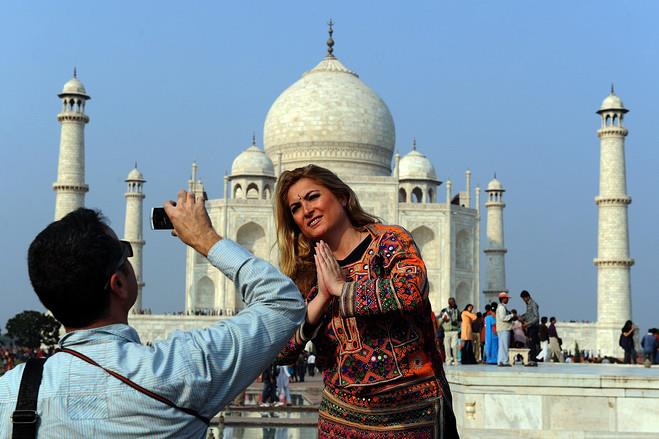

India, along with other tropical countries, is a popular choice for foreigners to escape to, from the unbearable winters in their respective countries. Nearly 7 lakh foreign tourists arrived in India until August 2016, which is nearly 12% more than the previous year. More than 1/3rd of the people travelling to India, travel for leisure.

For the domestic travellers, India has two tourist seasons which are congruent with the school holidays & wedding dates (muhurats).

Indians travelling abroad have immediately suspended their plans. Those travelling domestically have either rescheduled their plans or cancelled them, given the shortage of cash. Those already travelling domestically have been through nightmares, as cash withdrawals from ATMs were limited & often erratic.

Not only have Indian citizens travelling in India and abroad have been inconvenienced, but also foreigners travelling in India, post-demonetization, who have been hit harder. Being a cash-driven economy, foreigners keep a majority of their foreign exchange in cash. Post-demonetization, foreigners could exchange only Rs. 5000 a week at banks. They’re left with a huge amount of invalid currency that cannot be exchanged before they leave the country. Those not having enough cash with them weren’t able to withdraw substantial amounts to sustain their travelling.

Demonetization has affected intermediaries and ancillary businesses, as they have lost more than 70% of their normal business around the high season, due to the ‘all-cash’ nature of their businesses. Quite a lot of these businesses have applied for swipe machines. But their main obstacle is a fixed address of business, along with relevant licences.

Demonetization has not affected primary tourists businesses with respect to cashless transactions per se. But the overall business has suffered due to an immediate reduction in footfalls and actual business being conducted.

According to a survey report by online travel aggregator, Yatra.com, bookings done through agents accounts decreased dramatically where agents were paid in cash; and bookings made through personal accounts increased. Payments for a majority of these bookings were cashless, made by cards, digital payment wallets and through internet banking.