The implementation date of the infamous Goods and Services Tax (GST) is almost upon us but many are still not informed about how exactly the new taxation system is going to affect their lives.

With this article, we aim to shed some light on the subject and clear the air among the masses.

#1. What is GST?

The GST Bill is the biggest reform in the Indian indirect tax system since the economy started opening in 1991. From July 1 onwards, GST will absorb several central as well as state taxes and there will be one nationwide Central GST (CGST) and State GST (SGST), expanding over the entire value chain of all goods and services, with a few exceptions.

(Image Courtesy: IndianOnlineSeller.com)

#2. What will GST Replace?

A number of central and state taxes alike will be subsumed by GST.

The central taxes GST will absorb are:

#1. Central Excise Duty

#2. Duties of Excise (medicinal and toilet preparations)

#3. Additional Duties of Excise (Goods of special importance)

#4. Additional Duties of Excise (Textiles and textile products)

#5. Additional Duties of Customs (CVD)

#6. Special Additional Duty of Customs (SAD)

#7. Service Tax

#8. Central surcharges and cesses

(Image Coourtesy: The Indian Express)

The state taxes GST will absorb are:

#1. State VAT

#2. Central Sales Tax

#3. Luxury Tax

#4. Entry Tax

#5. Entertainment and Amusement Tax (except when levied by local bodies)

#6. Taxes on Advertisements

#7. Purchase Tax

#8. Taxes on lotteries, betting and gambling

#9. State surcharges and cesses

#3. What’s New in GST?

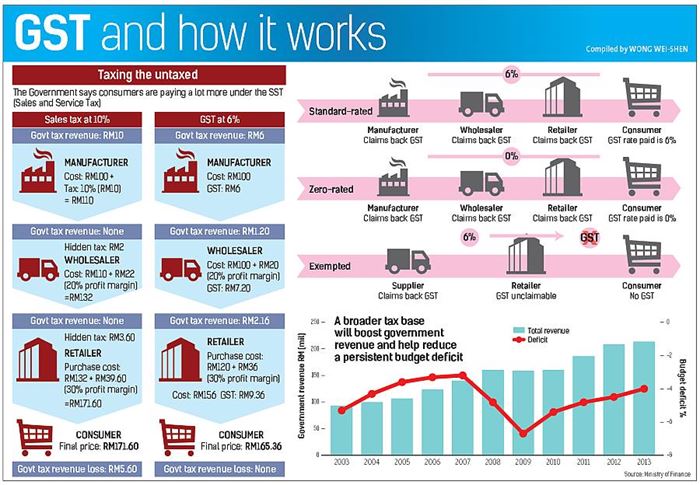

In the taxation system prior to GST, the consumer had to bear a burden of tax over tax. However, GST permits setting-off taxes that have already been paid on inputs and other past purchases. Therefore, a producer/seller has to pay taxes only on the value addition at each stage.

For instance, a shoe manufacturer spends INR 1000 on raw materials, which includes taxes amounting to INR 100. Now, after value addition, he sells the shoe for INR 1300. Traditionally, at a rate of 10 percent, he would have to pay INR 130 as taxes. Whereas, as per GST, now he will only have to shell out taxes on INR 300, which is the value added to the goods by him. Hence, he will incur a tax burden of INR 30, since INR 100 can be set off.

With GST, the government has established a uniform indirect tax rate and structure across the nation, which is believed to increase certainty and ease of doing business.

(Image Courtesy: Ministry Of Finance, Government Of India)

#4. What are the Tax Rates?

A few weeks before GST was planned to roll out, the government finalized on a four-tier structure, where the tax on varied goods and services will be charged at 5, 12, 18 or 28 percent. Education, healthcare and third-tier railway along with milk, eggs, meat, fruits, vegetables, flour, curd, stamps and more have been exempted.

The 5 per cent slab covers packaged food items, skimmed milk powder, branded cheese, frozen vegetables, coffee, tea, spices, cashew nuts, raisins, kerosene, coal, lifeboat, biogas, postage and revenue stamps. If you are looking to invest money in gold, then again GST of 5 per cent would apply. Whereas, frozen meat products, butter, cheese, ghee, fruit juices, cell phones, non-AC hotels, business class flight tickets, and fertilizers will fall under the 12 per cent tax slab.

The government decided to put most goods and services under the 18 per cent slab, which include telecom and financial services. Biscuits, flavored refined sugar, pasta, pastries, cakes, preserved vegetables, jam, sauce, ice cream, steel products, camera, speakers, printers, electrical transformers, and CCTVs are among these. If you wish to dress up nicely, then again a tax of 18 percent would have to be paid as branded garments are also in this slab.

Goods governing the highest, 28 percent, tax rates are paint, deodorants, shaving creams, shavers, hair shampoo, after shave, hair clippers, vacuum cleaners, automobiles and pan masala. Luxury hotels, race club betting, private-run state-authorised lotteries, and cinema to attract the same tax rate as well.

(Image Courtesy: Trak.in)

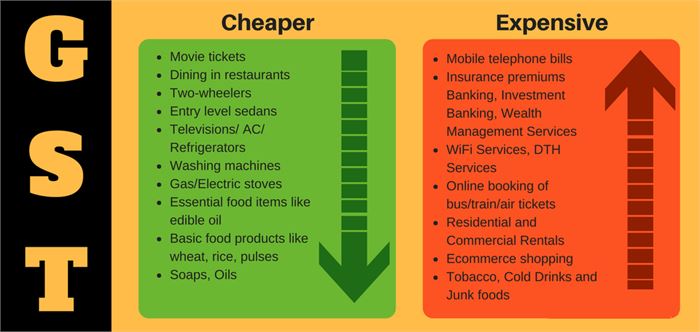

#5. How will GST affect the Taxation Of A Common Man?

For a common man, GST will be like bitter pills. As the GST gets implemented, renewal premium for life insurance policies, banking and investment management services, Wi-Fi, DTH services, online booking of tickets as well as mobile bills are expected to become more expensive. Whereas, watching a movie and dining out at a restaurant will become cheaper in some states. Prices of white goods like television and washing machines are likely to see very less or no change.

Among the many praising the bill, are Google’s CEO Sunder Pichai, and the President and CEO of Walmart India, Krish Iyer. Cloth merchants and textile traders are against 'complicated' GST rules. But mainly unawareness of the subject has led to confusion and agitation among the trading fraternity of the nation.

(Image Courtesy: GST Return India)

#6. Who will be benefitted and who won't?

Business owners across India will be benefitted since they will have to pay only one tax. Even retail businesses will flourish more owing to better logistics, seamless movement of materials, and improved supply chain.

Non-compliant (who fail to comply with GST) businesses will be affected.

#7. Online GST Registration

You can visit the official website of GST, under the Government Of India, http://www.gst.gov.in/ if you have any query about GST. Also, you can go for online GST registration, get GST forms, calculate your tax and get your query resolved here on the website only.

For enrollment related queries, you can call to the customer care at 0120-4888999.

You can watch the video to learn more about GST.

(Video Courtesy: IndianExpressOnline)

Read Also: How will GST benefit startups?

If you have some more information about GST, we would love to hear from you. Kindly use the comment box to share your thoughts and opinions with us.

(Featured Image Courtesy: Lawctopus)

GST will be transparent. GST will also bring luck and goodness into the system by streamlining operational efficiency and reducing unnecessary regulations https://www.kwikbilling.com/blog/a-businessmans-guide-to-gst-myths-facts-uncovered