After the demonetisation wave struck the country, digital payment providers have hit the jackpot.

But have we really arrived at a conclusive and unified cashless solution at the national level?

Dubbed as India’s very own ‘e-wallet’, the recent launch of BHIM app may be an indication. Let’s review in detail.

The BHIM (Bharat Interface for Money) app was launched by Prime Minister Narendra Modi on December 30th with the objective of facilitating digital transactions. Based on United Payments Interface (UPI) technology and created by National Payment Corporation of India (NPCI), this app works through your mobile phone and is directly linked to your bank account.

The app runs on UPI which essentially means that your bank account should be UPI supported and your phone number should be linked and verified. As of the now, the app supports 31 Indian banks and aims to add more banks in the coming months.

Industry experts believe so, they’re bullish on this app for many reasons.

Firstly, there is no upper limit for transfer of money (unlike a payment wallet) since it is directly linked to your bank account. Secondly, for the UPI-linked accounts, all you need is a Virtual Payment Address (VPA) and for those who do not have a UPI-linked account you can transact via IFSC or MMID. What’s more, the app is designed to work even without net connectivity.

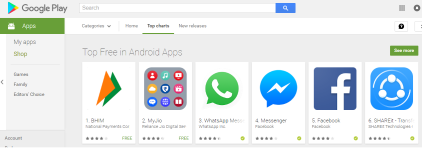

Within a week of its launch, the app has topped the charts in the ‘free apps’ category with over 3 million downloads and over 5 lac transactions. Given the fact that the app is only available to Android users (and is yet to be launched for iOS and Microsoft platforms), the volumes are massive.

Although there are initial bugs (which the government will take care of in the subsequent update), the app offers ease, convenience and is the first bank-independent cashless solution.

In the next phase, the app will incorporate fingerprint-impression based transactions.

What are you waiting for? https://play.google.com/store/apps/details?id=in.org.npci.upiapp