How can you describe the contribution of Raghuram Rajan’s work as the RBI Governor of India? When he took over from his predecessor, Dr. Duvvuri Subbarao on Sept 4, 2013; expectations were high because his reputation as an economist was huge. In 2005, Rajan alerted the world about the growing risks in the financial system while speaking at the annual Federal Reserve Jackson Hole Conference and his predictions came true later, following the 2008 economic crisis. Since then, the entire world was attentive and curious towards his words and actions.

In 2016, Times magazine chose him as one of the most influential individuals in the world (top100). His academic credentials, vibrant approach and achievements as an economist made the expectations of the Indian people high when he took charge as the RBI governor of India. At this juncture, when he is stepping down after completing his tenure of 3 years; let us analyze his contributions with an unbiased method of approach.

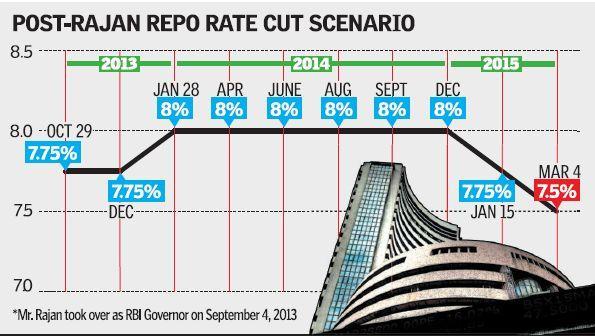

Hikes and cuts of repo rate under Raghuram Rajan’s tenure

When Raghuram Raja took charge, he issued a seven-page statement where he said that the fundamentally sound Indian economy has a bright future and him also categorically stated that he would preserve the value of the currency.

After a few months of assuming office, he hiked the repo rate by 25 bps to 7.75% and it was a major surprise for the market. It was being done to control the rising inflation and according to the Governor, it was important to break the spiral of rising price pressures. Retail inflation was fixed to remain over 9%.

Again after three months, he hiked the repo rate further by 25 bps to 8% by describing inflation as a tax that is grossly inequitable and according to him, it was falling hard on the very poor people. After one year, he cut the repo rates by 25 bps for the first time and within two months; he again came up with another repo cut by 25bps to 7.25%. To shift focus to growth, another repo rate cut of 25 bps to 6.75% was introduced after six months and during this stage, his principle was to build up a domestic demand to substitute the weakening global demand.

He believed that local demand and investment held the key in sustaining an incipient recovery. After having analyzed the situation for five months, Rajan cut the repo rate by 25 bps to 6.5%. When we analyze his repo operations deeply, we can come to the conclusion that all these operations were primarily targeted on infusing liquidity and they always ensured better pricing of credit in the market.

Other major achievements

Other major steps include granting universal bank licenses to micro-finance sector players like Bandhan Financial services and IDFC Limited, announcing final guidelines for differentiated bank license, entering into an agreement with government for monetary a policy framework with an objective of maintaining inflation below 6%, granting in-principle license to 11 companies to start payment banks and allowing permission to 10 entities to start small finance banks as well.

As the governor of the Reserve Bank of India, Raghuram Rajan, introduced a wide range of measures for smoothening liquidity supply to allow banks lend money to the productive sectors and he also supported the decision of the government to amend the RBI Act. According to him, creating a monetary policy committee would strengthen the credibility of the policy.

His announcement of a special swap window to shore up forex reserves brought in a lifetime high of $34 billion and the Bank Clean Up process was one of the most important decisions taken by Rajan. The Asset Quality Review by RBI forced banks to classify visibly stressed assets as nonperforming assets and this situation resulted in a surge in bad loans. To tackle this problem, RBI offered a wide range of tools and these tools helped banks convert at least 50% of bad loans into long-dated equity instruments.

The inflation rate came down to 5% from a two digit figure during his tenure and he introduced a solid framework for foreign investors participating in the bond market. The stock market showed powerful upward movement up to 41% during his three years and he made the monetary policy extremely appealing to the common man as well.

What do financial experts say?

Most financial experts unanimously agree that contributions made by Rajan are exemplary and his decisions and actions reinstated confidence at a challenging time in the Indian economy. He made highly beneficial many structural changes in areas like banking regulations, monetary policy and exchange rate and all these steps were being implemented with the best intention of taking Indian economy into different level altogether.

Raghuram Rajan is undoubtedly one of the most skillful financial, economic thinkers in the world and his decisive policy actions during his tenure as the RBI governor have played a major in strengthening the changing perceptions about the true power of Indian economy. Most importantly, he made all decisions based on profound understanding of the underlying causes and robust analysis and, it can be said without an iota of doubt that his visionary approach is going to benefit the Indian economy tremendously in the years to come.

He is the best only silver lining in BJP tenure then also that clown Subramaniam swamy criticised him

Urjit Patel to Succeed Raghuram Rajan as RBI Governor. He will take over after current governor Raghuram Rajan's term ends on September 4 2016.